Building Automation Systems

Summary Intelligence Report

Introduction

According to the International Energy Agency (IEA), the global floor area is experiencing rapid growth, especially in developing countries. This trend suggests a corresponding increase in the consumption of heating and cooling appliances, notably air conditioners.1 Consequently, this surge in consumption is poised to escalate greenhouse gas (GHG) emissions resulting from heightened usage. For instance, Canadian homes and buildings contribute to 13% of the national GHG emissions, primarily due to fossil fuel combustion for space and water heating, as well as cooling. When factoring in electricity consumption for cooling, lighting, and appliances, this figure rises to 18%.2

Given the prolonged lifespan of buildings and structures, decisions made today regarding heating and cooling systems, auxiliary equipment, and appliance design and procurement will significantly influence energy usage for many years to come. In response to these challenges, building automation systems (BAS) have emerged as sophisticated computer network systems tailored to automate and oversee various building systems. The primary objective of BAS is to enhance the comfort, safety, security, and convenience of building occupants, all while concurrently bolstering energy efficiency.

IAC’s report reflects on these challenges, innovations and developments.

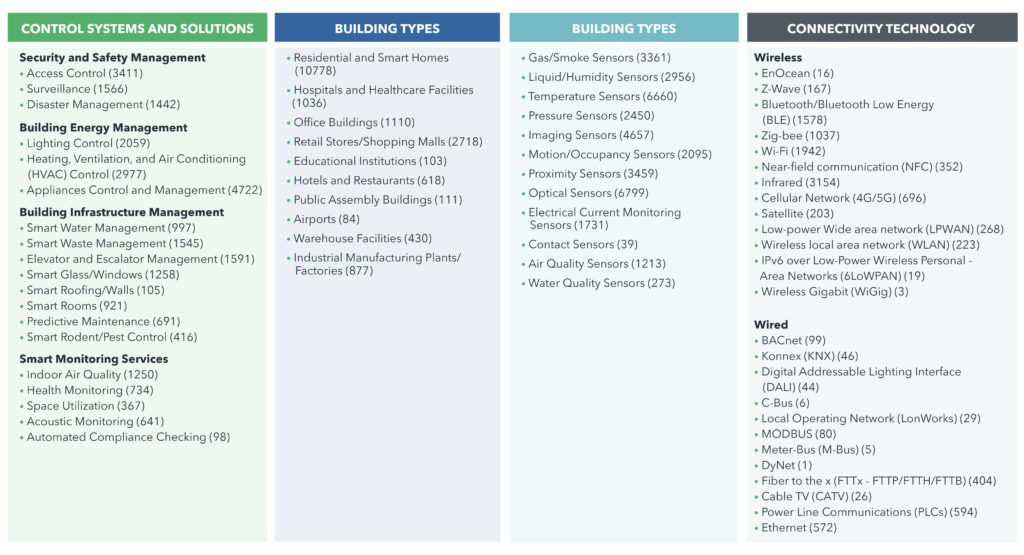

IAC’s report on Building Automation focuses on patent filings that are related to Control Systems and Solutions, and further sub-divided into sub-categories., viz. Building Types, Data collection sensors and Connectivity Technologies.

The report further delves into the dynamic competitive landscape of the building automation ecosystem, analyzing the progression of innovation and commercial activities across various segments.

24,701 patent families were analyzed for this report. These patents were categorized into various technologies using a technology taxonomy as seen below.

Fig. 1.1 Technology Taxonomy for Building Automation Systems

Key Takeaways

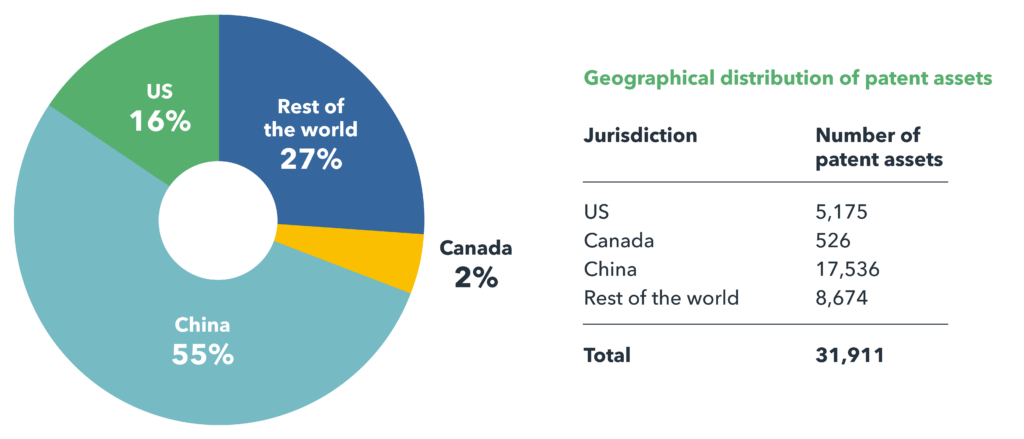

Geographic Filing Trends

For geographical patent filing analysis, a total of 31,911 patent filings were considered in the report, of which, approximately 55% are filed in China. Excluding China, with 5,175 patent filings, the US emerges as the top preferred jurisdiction for filings, reflecting typical filing strategies where companies prioritize regions with the highest revenues and associated risks. 526 patent assets are filed in Canada, making it the 8th most preferred jurisdiction for patent filing.

Technology and Industry Trends

While insights in the report are derived from patent filings relevant to Control Systems and Solutions, the identified patent dataset from ‘Control Systems and Solutions’ are further tagged in these three Tier 1s (‘Building Types’, ‘Data collection sensors’, and ‘Connectivity Technologies’. Diving deeper into the technology trends, the study reveals that Building Energy Management is the most sought for patent protection (9,048 patent families) with a focus on HVAC related technologies (2,811 patent families). Patent filings in HVAC related technologies are consistent with the global trend with Siemens and Alphabet contributing the most to Canadian patent filings in HVAC. Most of the patents are based on technologies for Residential and Smart Homes (60% of all the various building types considered in this study).

Role of Communication Protocols and Standard Essential Patents

Building automation integrates connectivity technology into mechanical products, heavily relying on standardized patented connectivity standards. Industry organizations such as Konnex and the DALI Alliance manage standards specific to building automation.

For example, KNX is an EN 50090 and ISO/IEC 14543 standardized communications protocol that manages various building functions like lighting, heating, ventilation, and security. Similarly, the Digital Addressable Lighting Interface (DALI) is a standardized protocol for controlling individual lighting fixtures, with its international standard IEC 62386 published by the International Electrotechnical Commission (IEC). Standards like KNX, DALI, 4G, 5G, Z-wave, and Zigbee may be subject to SEPs. Companies must license these patents under Fair, Reasonable, and Non-Discriminatory (FRAND) terms. SEP declarations are voluntary and may not be comprehensive, leaving the possibility of undeclared SEPs pertaining to building automation systems.

Startups are pivotal in introducing feature-rich products and services by leveraging protocols such as Z-Wave, ZigBee, and EnOcean. LoRa, a newcomer in this landscape, addresses the demand for low-power WAN solutions for IoT, offering impressive coverage and extended battery life. Noteworthy corporations like IBM, Cisco, Semtech, and Multi-Tech Systems are actively engaged in manufacturing LoRa-enabled hardware, signaling a commitment to innovative wireless solutions.

Key players

IAC’s full report on Building Automation Systems reflects on the patent filing trends, mergers & acquisitions, key products, etc. of key players to give a holistic overview of the technology and market dynamics. Here are some of the observations with regards to the key players globally:

- Johnson Controls, Siemens and Honeywell are among top players that have the largest number of patent assets pertaining to Building Automation.

- Haier and Gree Group are leading Chinese companies ranking among the top patent filers. In contrast, other Chinese companies like State Grid Corp of China and Xiaomi are also prominent in global patent assignments, but their granted patents tend to have lower numbers and quality scores, indicating weaker enforceability compared to their peers.

- Alphabet, Resideo Technologies, and Samsung are among the top filers that have the highest number of granted patents.

SMEs must therefore be wary of the formidable patent positions of these players in each jurisdiction. Diverse patent and product portfolios of large players like Johnson Controls, Schneider Electric, ABB, Resideo Technologies, and Honeywell suggest that their patent filings cover a broad range of products, demonstrating a comprehensive approach to innovation and IP ownership.

Key players in Canada

The following highlights reflect on some of the key findings in the report specific to key players in Canada:

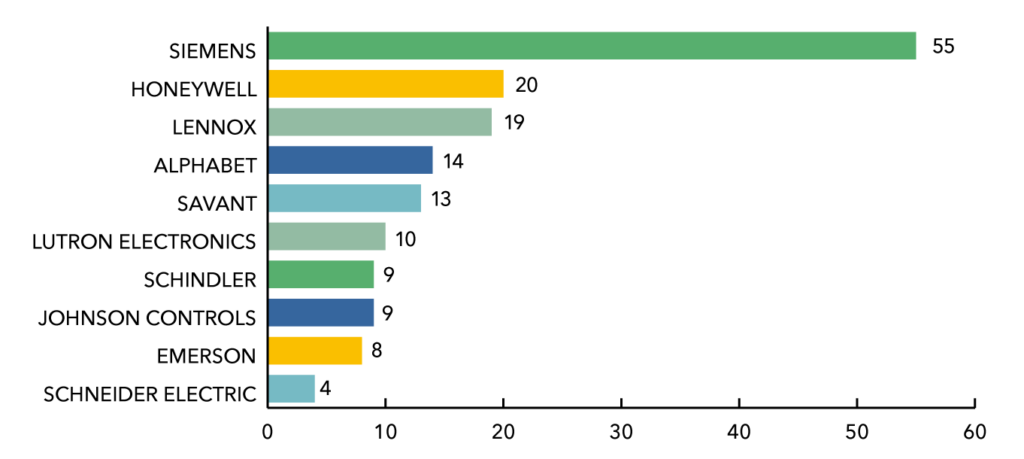

- Although Johnson Controls stands out as the top assignee worldwide, it has fewer patent filings in Canada than Siemens. However, Johnson Controls has the highest number of granted patents and a better patent quality score than Siemens.

- Despite being among the top assignees globally, key Chinese companies show minimal filings in the Canadian jurisdiction, indicating a focus elsewhere.

- Notably, no Canadian company ranks among the top 10 key assignees in Canada, highlighting a gap in the local patent landscape. While Delta Controls and Brainbox AI are key market players in Canada, their patent filings within the country appear to be relatively low.

Fig. 1.3 Top filers in Canada – Building Automation Systems related technologies

Value Chain

IAC’s landscape report provides a detailed depiction of the value chain associated with the key players involved in various parts of the Building Automation Systems value chain. The categories shown in fig 1.4 are broadly aligned with the technology taxonomy in this study while covering various aspects of the value chain starting from suppliers of smart equipment to delivering smart monitoring services. A detailed analysis of the value chain vs. Intellectual Property shows that several companies operating in various segments of the value chain do not have significant patent portfolios. It’s possible that their portfolios fall outside the scope of this study, yet they may still hold patents related to building automation. Additionally, some may hold licenses for pertinent technologies.

A detailed value chain for Canadian players active globally and Canadian and global players active in Canada is included in the full report.

Fig. 1.4 Worldwide value chain – key players active in building automation systems

IP Risk & Strategy for SMEs

Companies like Honeywell, Siemens, Johnson Controls, Samsung, Mitsubishi not only have greater legal and financial resources but also own a high number of granted patents having more than 10 years of estimated remaining life, thereby potentially posing a threat to relatively smaller players operating in or wanting to enter this space. Therefore, SMEs must navigate risks associated with the IP owned by others, such as these large players. Some of these strategies may include:

Patent Portfolio Development – Strive to build a robust patent portfolio that protects your innovations and deters competitors. Without a significant portfolio of patents, a smaller company involved in an IP dispute with a large company typically lacks the leverage that the ability to counter assert provides. The primary purpose of IAC’s Portfolio is to provide patents that can be counter asserted against companies with large portfolios that could pose a risk to member companies. Read more about IAC’s Patent Portfolio here.

Geographical Considerations – Assess patent rights on a country-by-country basis, as patent laws and enforcement practices vary across jurisdictions. A product or service that may be covered by a patent in one country may not be in another because a similar patent may not exist or be active, or the claims may have different scopes.

IP Strategy & Ownership – Prioritize the protection of your intellectual property and put in place strategies to increase its value and minimize risk. These steps are a good start towards increasing your Freedom-To-Operate. IAC’s IP Education program empowers companies to develop and maintain solid, scalable, forward-thinking IP and data strategies.

IAC’s detailed IP Intelligence Reports provide additional IP strategies to increase your business’s value and mitigate risks posed by other entities and are available exclusively to our members. To access the full Building Automation report and other valuable resources, click the button below to explore the advantages of an IAC membership.

References

1 Buildings – Energy System – IEA

2 Annex: Homes and buildings – Canada.ca

Disclaimer: The content of this document may have been derived from information from third-party databases, the accuracy of which cannot be guaranteed. IAC hereby disclaims all warranties, expressed or implied, including warranties of accuracy, completeness, correctness, adequacy, merchantability and/or fitness of this document. Nothing in this document shall constitute technical, financial, professional, or legal advice or any other type of advice, or be relied upon as such. Under no circumstances shall IAC be liable for any direct, indirect, incidental, special, or consequential damages that result from use of or the inability to use this document.