Energy Storage 2024

Summary Intelligence Report

Introduction

The energy storage market is on a fast growth trajectory, with global capacity expected to surpass 1,200 GW by 2030. (Source) This growth is essential for integrating renewable energy into power grids and advancing the transition to net-zero emissions. Electric vehicle battery deployment surged by 40% in 2023 and is projected to grow 4.5 times under current scenarios, with even greater growth anticipated in net-zero pathways (Source). Batteries are central to this shift, driven by accelerating EV adoption, declining costs, and supportive government policies. Meanwhile, grid-scale systems are expanding rapidly, benefiting from cost reductions and enhanced reliability, further cementing their role in renewable energy integration.

However, the sector faces headwinds from economic pressures, such as inflation, supply chain disruptions, and regional disparities in manufacturing dominance. China accounts for over 70% of battery production and mineral processing, creating supply vulnerabilities for other regions. While efforts to diversify supply chains and reduce reliance on Chinese imports are underway, progress remains slow. Despite these challenges, strong policy support, advancing technologies, and stabilizing mineral prices continue to bolster the market’s resilience and growth.

IAC’s report reflects on these challenges, innovations and developments.

IAC’s Energy Storage report delves into the dynamic competitive landscape of the energy storage ecosystem, analyzing the progression of innovation and commercial activities across various segments. This study identifies and discusses the evolution of battery and energy technologies under three broad categories: (a) electrochemical, (b) electrical and (c) chemical energy storage.

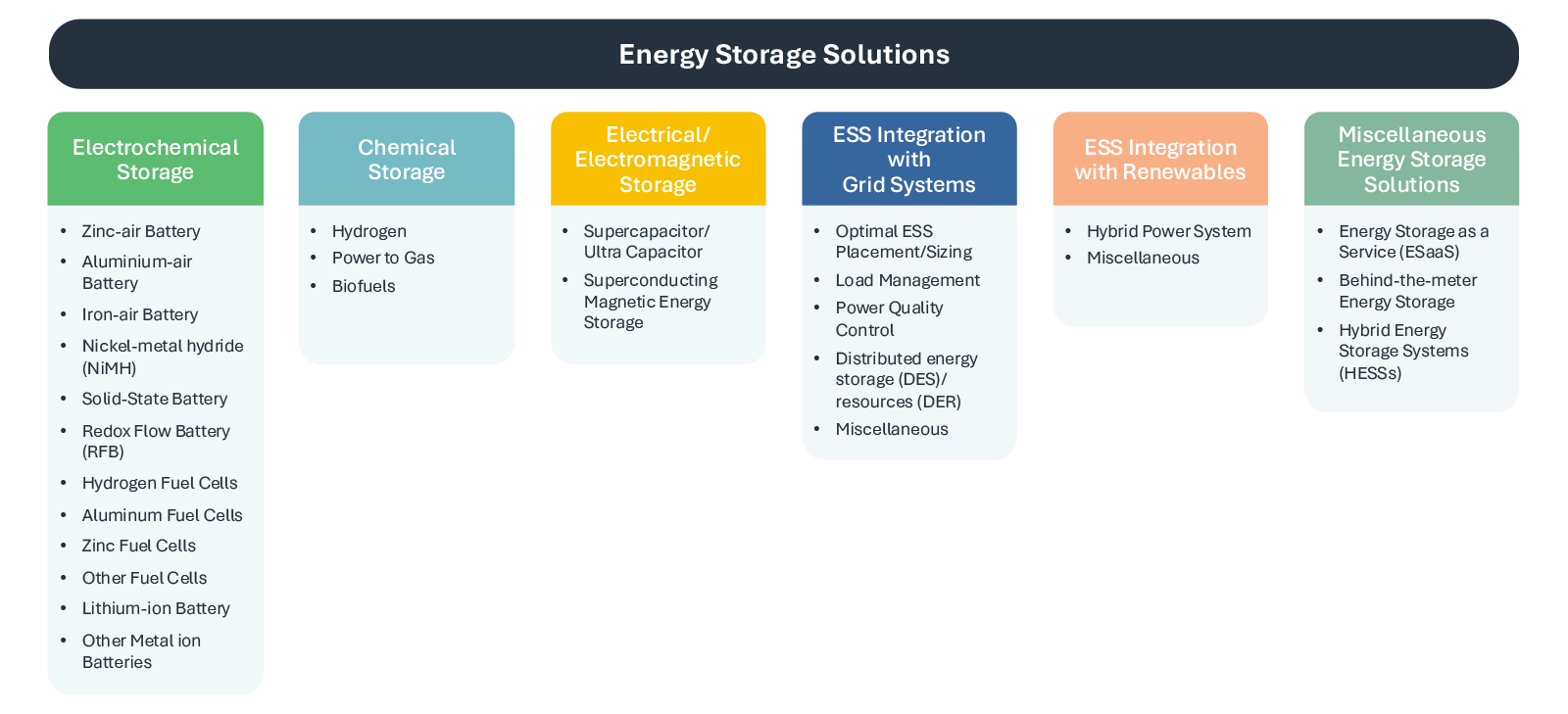

72,227 (102,578 patents) patent families were analyzed for this report. These patents were categorized into various technologies using a technology taxonomy as seen below.

Fig. 1.1 Technology Taxonomy for Energy Storage Solutions

Key Takeaways

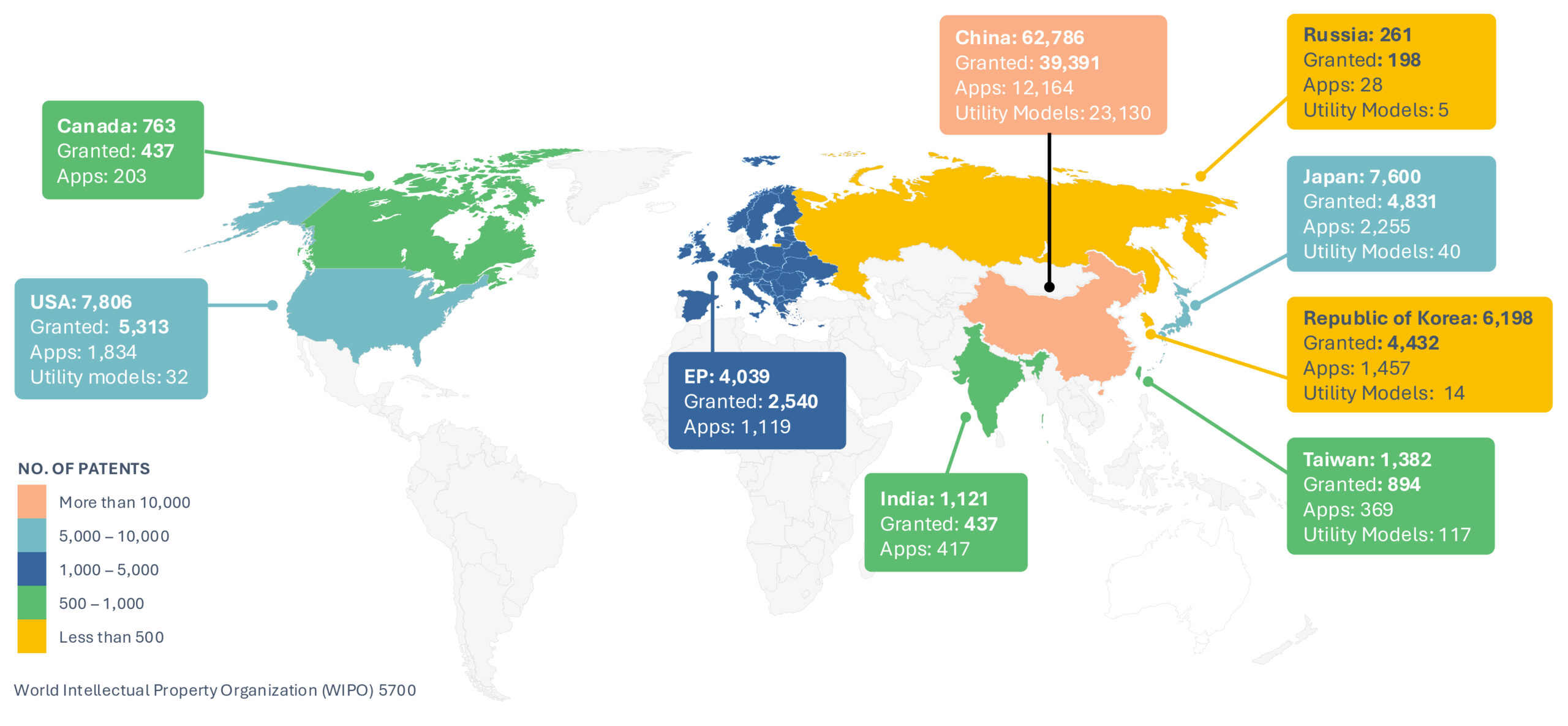

Geographic Filing Trends

For geographical patent filing analysis, a total of 102,578 patents in the expanded dataset were considered. Patent filings in the energy storage sector have shown significant growth since 2014, with a sharp rise starting in 2017. China dominates with 81% of the global filings, accounting for 58,410 patent families filed between 2005 and 2024. By comparison, the U.S. contributed approximately 3,204 filings in the same period. Overall, China’s significant contribution to the patent filings in energy storage highlights its pivotal role in shaping innovation trends in this space.

Li-ion Batteries Drive the Dominance of Electrochemical Energy Storage Patent Filings

Electrochemical storage technologies dominate the energy storage sector, representing 91% of all patents in the study. Lithium-ion (Li-ion) batteries account for 69% of these filings, reflecting their prominence and rapid growth as the fastest-expanding market segment. Other storage solutions, such as metal-ion batteries (10,288 patents) and hydrogen fuel cells (5,825 patents), also show significant innovation, highlighting efforts to address diverse and evolving energy demands.

Li-ion batteries are critical for both electric vehicles (EVs) and energy storage applications. Chemistries like lithium iron phosphate (LFP), which are adaptable to mineral availability and cost constraints, have gained traction, now comprising 40% of EV sales and 80% of new battery storage in 2023. Patent filings in the Li-ion sector have grown at a compound annual growth rate (CAGR) of 27% between 2012 and 2021, demonstrating robust innovation.

China’s Dominance

China leads global patent filings in this sector, showcasing its strong innovation economy and significant investments by domestic firms. Other Asian entities and global automobile manufacturers also contribute to the rapidly expanding patent landscape, further emphasizing the global focus on advancing Li-ion technology.

Key players

Top patent assignees in energy storage include Toyota, State Grid Corporation of China, Samsung, LG, Gotion, and Sumitomo. Chinese companies such as Gotion and State Grid Corporation have demonstrated the most consistent growth overall. Notably, major Chinese manufacturers like CATL, BYD, and SVOLT, while having a significant number of patent publications, do not rank among the top 10 global filers, a surprising trend given their market prominence. On the other hand, Chinese academia dominates patent filings in the non-electrochemical energy storage categories.

Highlights for Canada

Similar to global trends, patent filings in Canada are dominated by electrochemical storage technologies. However, the low number of filings—highlights a lack of interest in the Canadian market.

Only 67 patent families have been filed in Canada, with 75% focused on electrochemical energy storage and 48% specifically on lithium-ion batteries. This growth has been significantly slower than the global trend, even when excluding China. LG, FuelCell, Toyota, and BASF are the top filers in Canada.

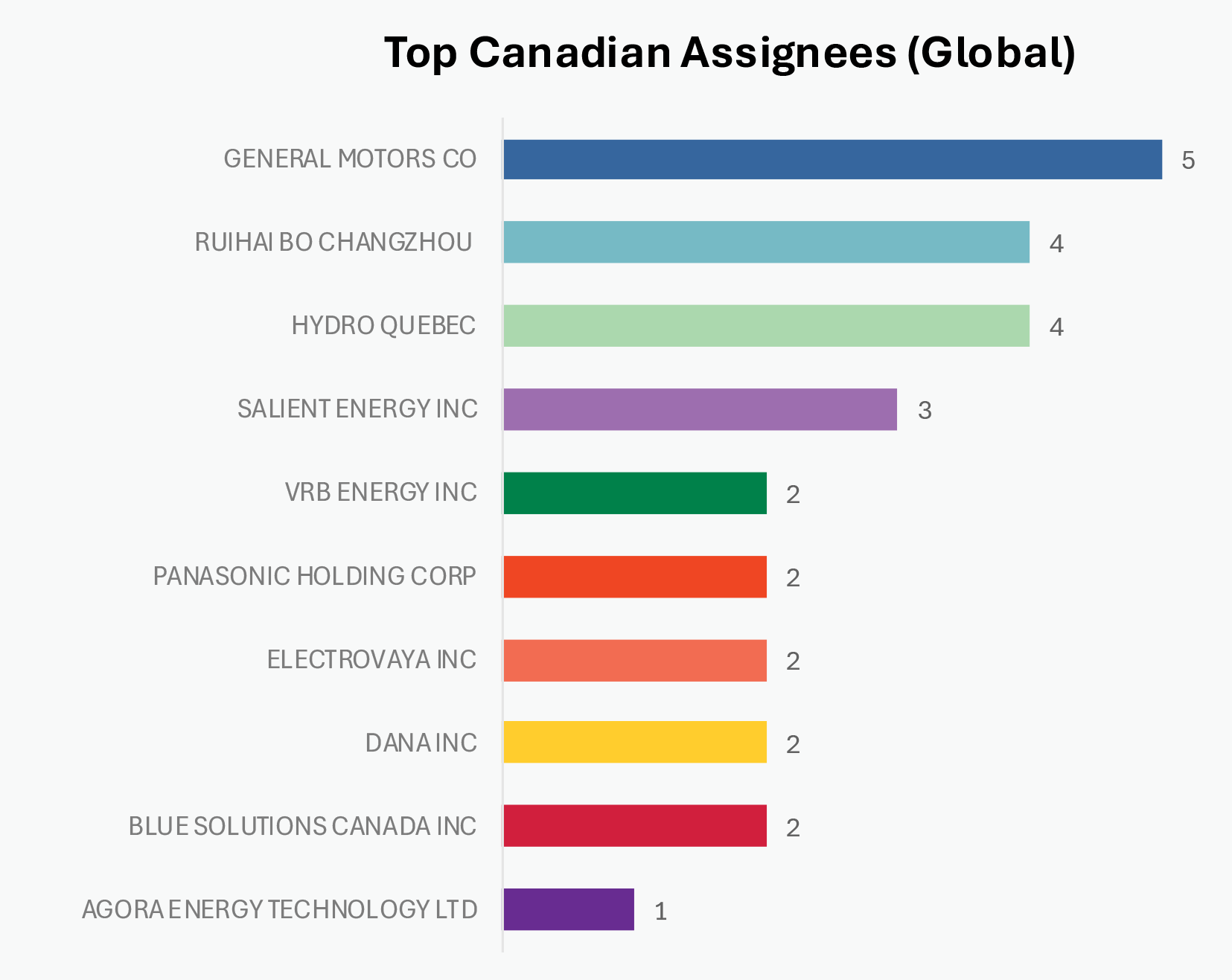

Notable Canadian companies with worldwide patent ownership include Hydro Quebec, GM Canada, and Salient Energy. Globally, Canadian companies own just 88 patent families, reflecting weak IP positions that leave them exposed to significant risks. Without strong IP portfolios, companies miss out on valuable revenue streams such as licensing and royalties and face challenges in accessing markets, often falling behind competitors with more robust patent holdings. A weak IP strategy can also make businesses vulnerable to infringement lawsuits and market exclusion.

Fig. 1.3 Top filers in Canada – Energy Storage

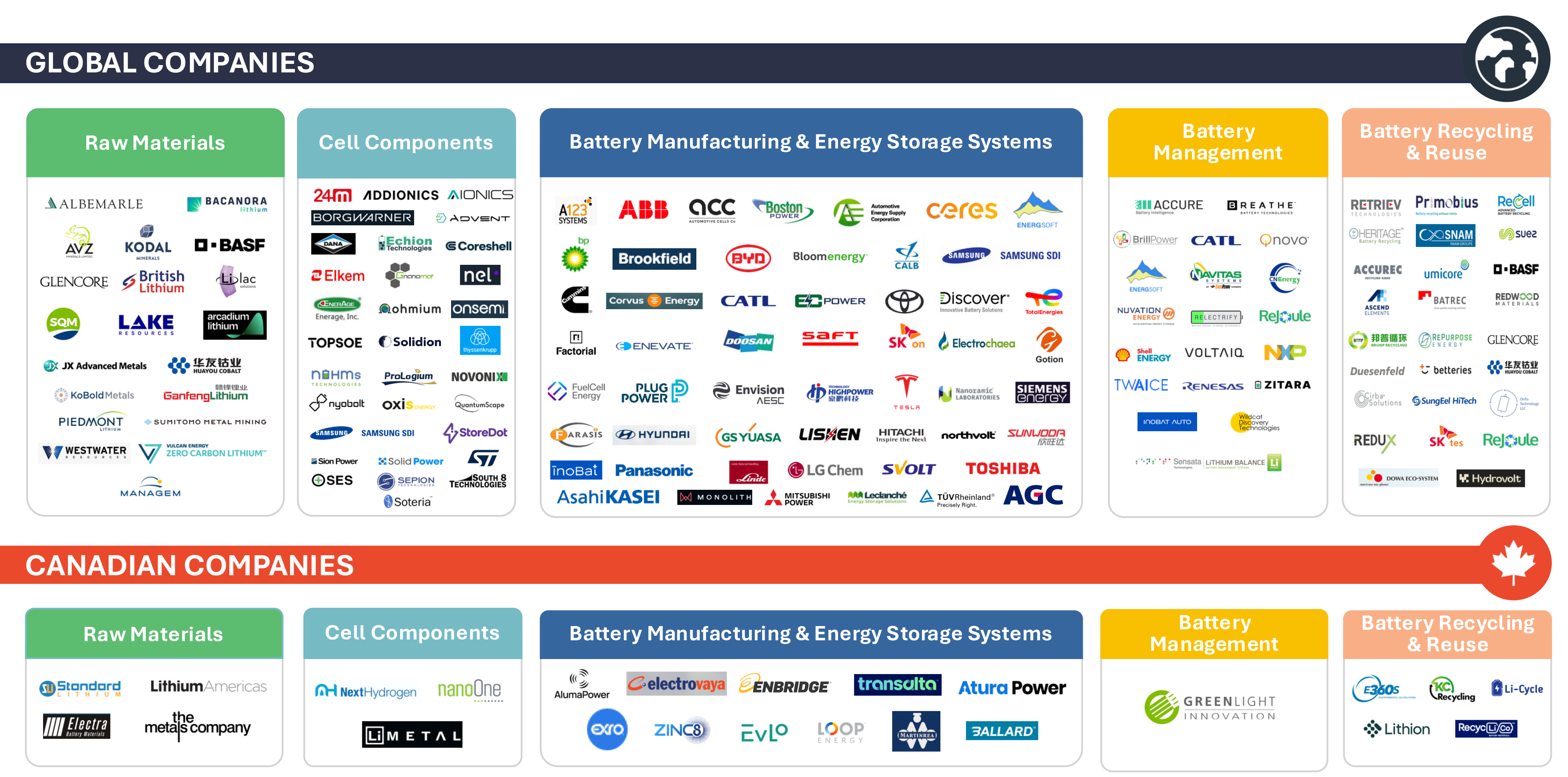

Value Chain

IAC’s landscape report provides a detailed depiction of the value chain associated with the key players involved in various parts of the Energy Storage value chain. The categories shown in fig 1.3 represent the sector-wide global value chain ranging from suppliers of raw materials to companies that recycle batteries.

A detailed value chain for Canadian players active globally and Canadian and global players active in Canada is included in the full report.

Fig. 1.4 Worldwide value chain – key players active in Energy Storage

IP Risk & Strategy for SMEs

Looking at the patent portfolios of key players like Toyota, Samsung, LG, Sumitomo, Gotion and Panasonic can provide some insights on successful IP strategies as well as risks associated with this space. These are well-positioned global players in the energy storage space with large portfolios and products covered by patent protection. These players are also amongst the top patent filers across various technologies in energy storage as detailed in the previous sections.

Patent Portfolio Development: Strive to build a robust patent portfolio that protects your innovations and deters competitors. Without a significant portfolio of patents, a smaller company involved in an IP dispute with a large company typically lacks the leverage that the ability to counter assert provides. The primary purpose of IAC’s Portfolio is to provide patents that can be counter asserted against companies with large portfolios that could pose a risk to member companies. Read more about IAC’s Patent Portfolio here.

Geographical Considerations: Assess patent rights on a country-by-country basis, as patent laws and enforcement practices vary across jurisdictions. A product or service that may be covered by a patent in one country may not be in another because a similar patent may not exist or be active elsewhere, and the claims may have different scopes.

IP Strategy & Ownership: Prioritize the protection of your intellectual property and put in place strategies to increase its value. These steps are a good start towards increasing your Freedom-To-Operate. IAC’s IP Education program empowers companies to develop and maintain solid, scalable, forward-thinking IP and data strategies.

For a comprehensive overview of these and additional IP strategies, including detailed patent and market data on key players, trends, and jurisdictional considerations, refer to the full report.

Disclaimer: The content of this document may have been derived from information from third-party databases, the accuracy of which cannot be guaranteed. IAC hereby disclaims all warranties, expressed or implied, including warranties of accuracy, completeness, correctness, adequacy, merchantability and/or fitness of this document. Nothing in this document shall constitute technical, financial, professional, or legal advice or any other type of advice, or be relied upon as such. Under no circumstances shall IAC be liable for any direct, indirect, incidental, special, or consequential damages that result from use of or the inability to use this document.