Electric Vehicles Ecosystem

Summary Intelligence Report

Introduction

16.5 million electric cars were on the roads globally by the end of 20211. The Electric Vehicle (EV) market is expected to grow at a CAGR of 33.6% from 2020 to 2027. It is expected to reach $2,495.4 billion by 20272. Key factors driving the growth of electric vehicles market include supportive government policies and regulations, increasing investments by leading automotive OEMs, rising environmental concerns, decreasing prices of batteries, and advancements in charging systems technologies.

According to an IEA report, to reach net zero CO2 in 2050, the share of EVs in total sales needs to reach around 60% by 20303. There is a push from government agencies worldwide towards developing an EV ecosystem to counter vehicular emissions from internal combustion engine vehicles. For example, Electric Vehicles Initiative (EVI) is a multi-government policy forum which is dedicated to accelerating the introduction and adoption of electric vehicles. Countries participating in the initiative include Canada, Chile, China, Finland, France, Germany, India, Japan, the Netherlands, New Zealand, Norway, Poland, Portugal, Sweden, and the United Kingdom.

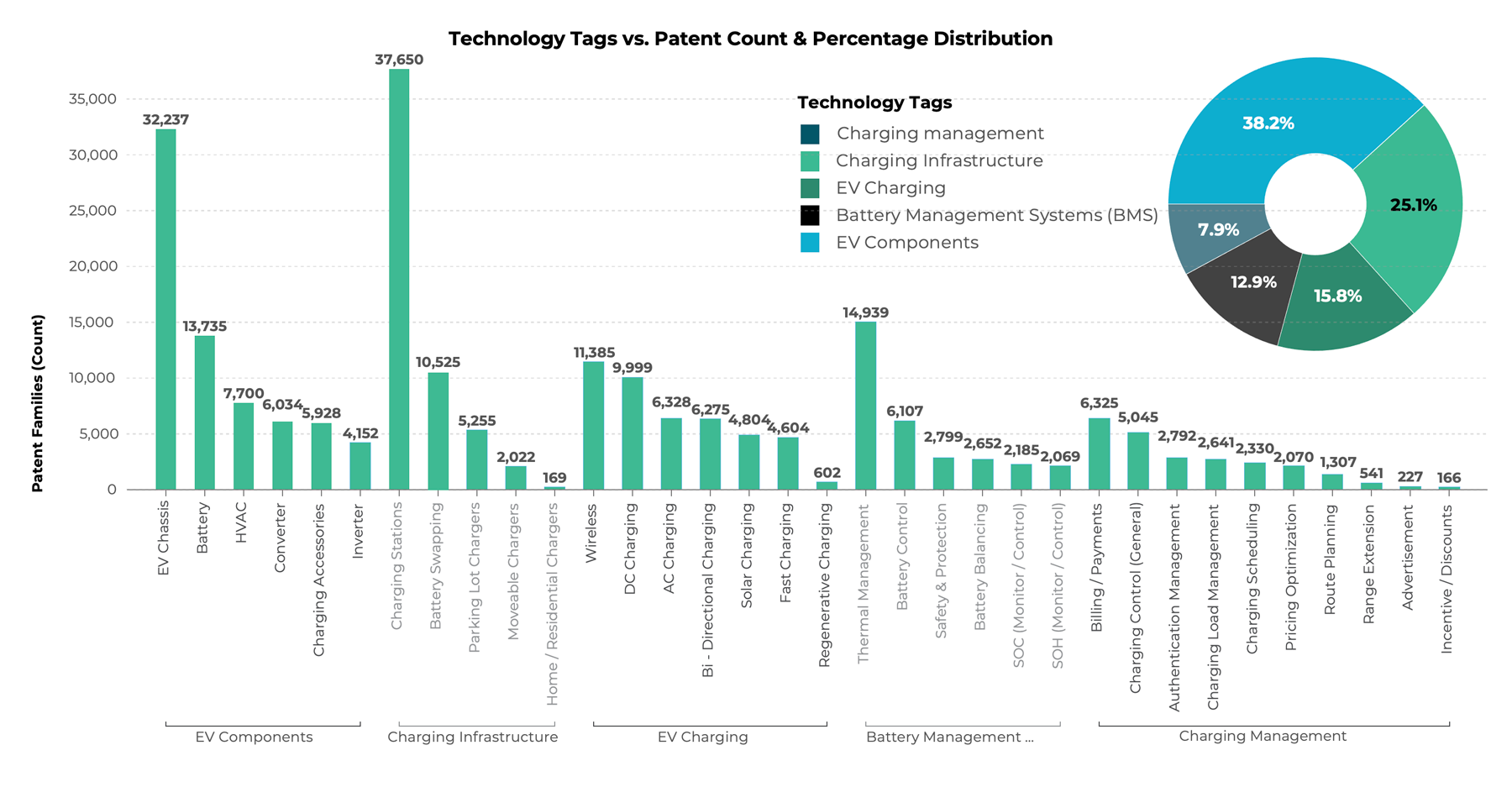

IAC’s report illustrates the competitive landscape in the global EV space and the progression of innovation and commercial activities within the ecosystem. Patents relating to key technologies from EV battery manufacturers, EV component suppliers, EV manufacturers and EV charging infrastructure and equipment providers have been classified in accordance with the study’s taxonomy, and then analyzed to understand trends and gaps. This study also explores and provides details around the value chains for EV manufacturing and EV charging services. About 170,000 patent families (see fig. 1.1) were analyzed for this report. The patent dataset retrieved is based on the earliest priority date (date of the first filing) starting in 2010. Market data taken from publications, articles and literature available since 2017 was also retrieved and analyzed.

Power generation, distribution, battery manufacturing, and non-electric vehicles (hybrid vehicles, toys, medical transport devices, robots, gardening equipment, etc.,) have been excluded from the scope of this study.

Fig. 1.1 Patent data distribution across the EV ecosystem technologies identified in the study

Key Takeaways

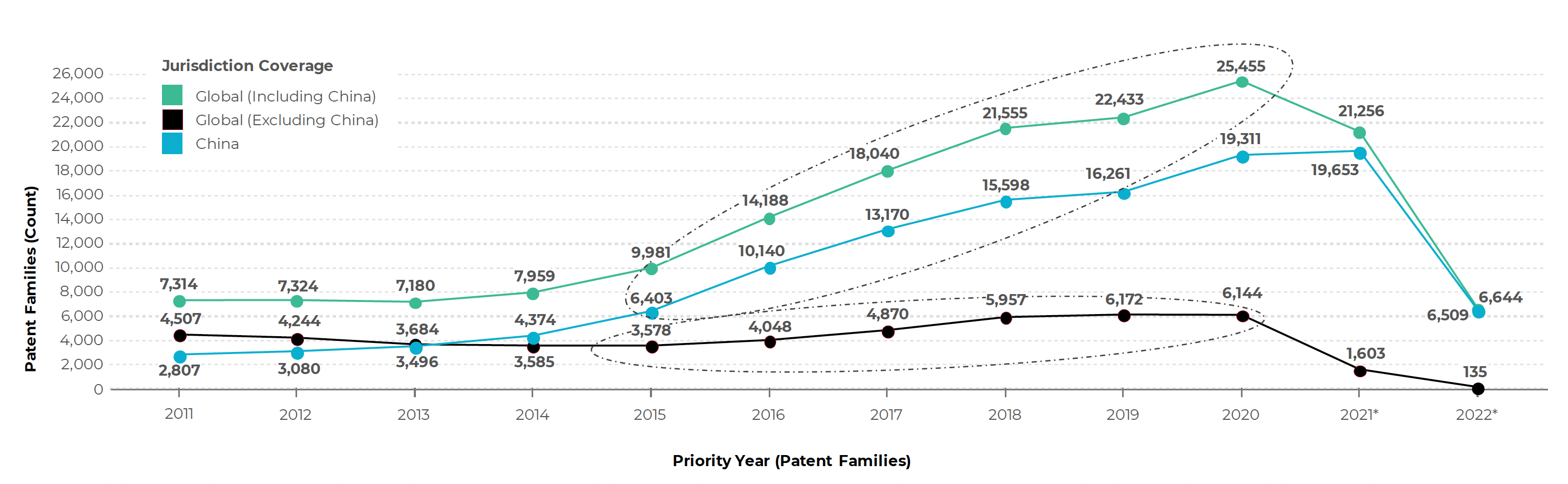

Geographic Filing Trends

China leads the global patenting activity in the EV ecosystem by accounting for about 71% of the total patent filings. However, it is noteworthy that 65% of these filings are either filed or granted in China only. These filings are propelled by Chinese OEMs (makers of EVs) such as BYD, NIO, battery makers such as CATL and utilities/service providers such as State Grid and Chinese Academia. When we look at patent filings by countries other than China, a gradual growth trend is seen with a year-over-year growth rate of about 10% from 2016-2020.

Fig. 1.2 Yearly patent filing trend in the EV ecosystem

IAC’s full report gives a more granular view of patenting activity globally with and without China.

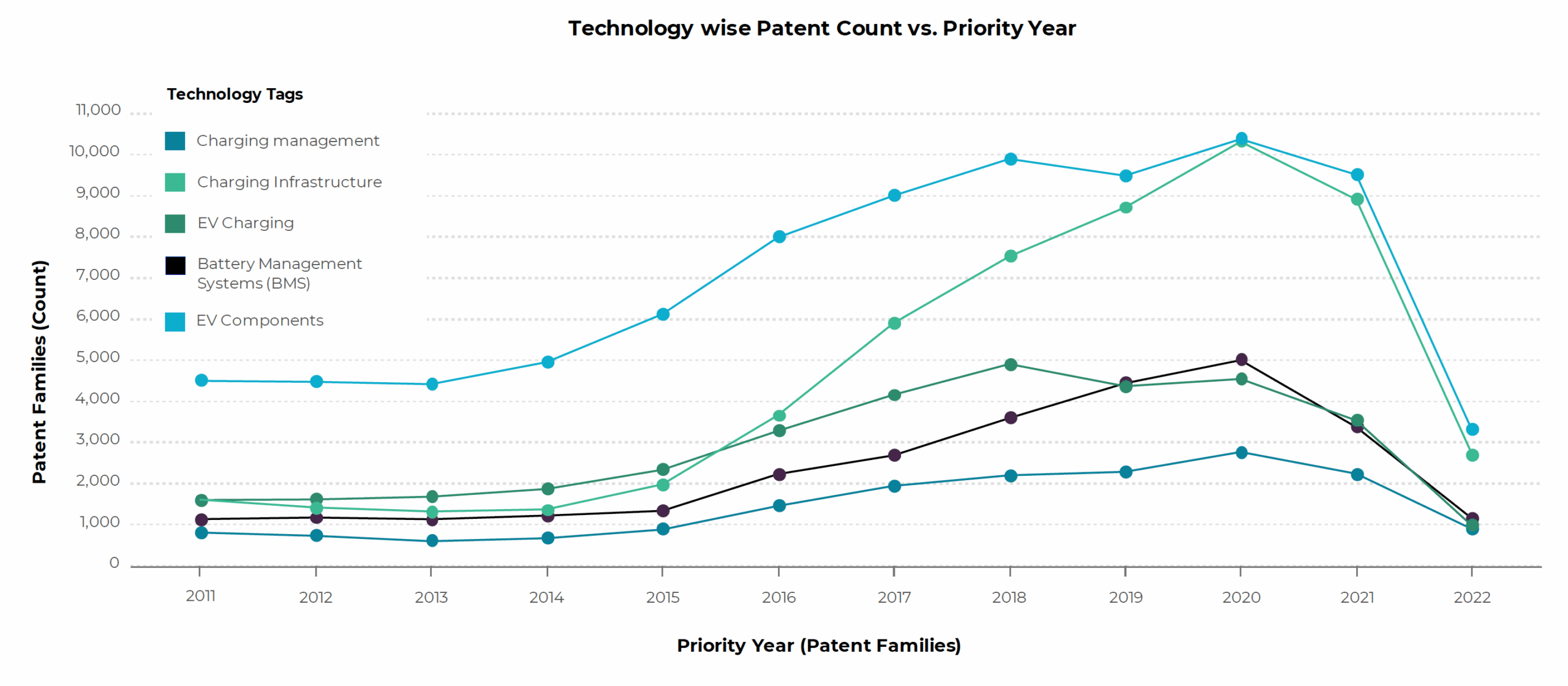

Technology Trends

As seen in Figure 1.3, when we look at the trends with respect to the technologies disclosed in the patents, IP activity for EV components has been leading and continuously growing since 2014. These technologies include hardware and accessories which are applicable to multiple parts of the EV ecosystem. However, since 2015, IP activity related to charging infrastructure has also risen and seen a five-fold jump. Charging infrastructure and battery manufacturing are the top technologies getting investments from multiple industry players whereas battery and charging management are the top technologies that are gaining traction in terms of global patent filings. Interestingly, AI/ ML and blockchain are some of the key technologies used for enabling EV related service solutions such as charging management, billing & payments, and authentication.

Fig. 1.3 Yearly Global Technology Trend

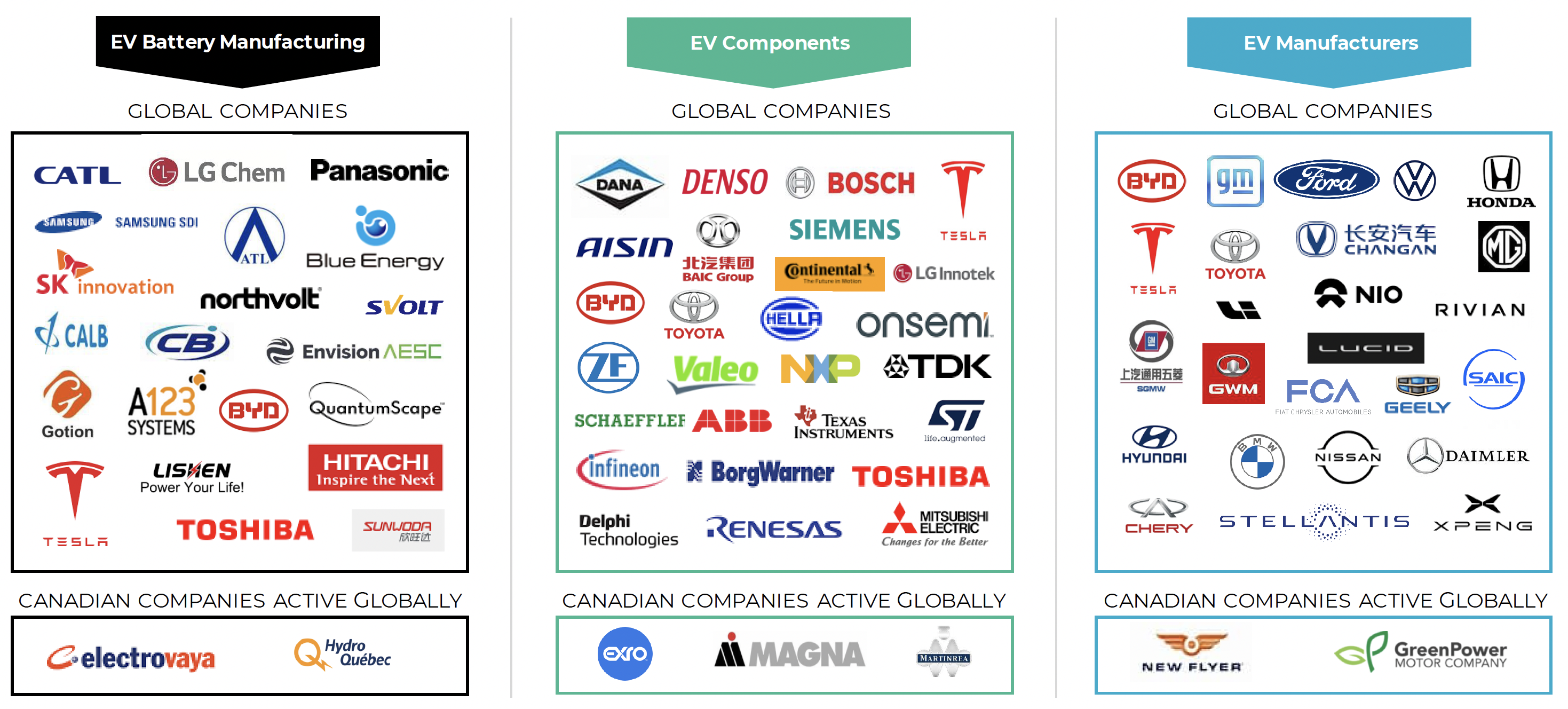

Key Players

Toyota, Hyundai, Honda and BYD are some OEMs dominating globally in the EV market. Suppliers of EV components that are leading in the patenting activity include LG, Bosch, Denso, Panasonic, and Siemens. The sector has also seen major collaborations such as Honda with Sony and CATL; GM with Microvast and Australian mineral supplier Queensland Pacific Metals; and Toyota with Oncor for a pilot project on V2G technology.

Nissan, Bombardier, Siemens, and GE dominate patent filings in Canada. New Flyer Industries and Electra Meccanica are two Canadian OEMs accounting for 6 patent filings in total in Canada while Hydro-Quebec leads among the utility companies. Amongst Canadian companies, Magna (138 total patent families globally), Bombardier (123), and Hydro-Quebec (51) have the most global filings.

Canada’s Thriving EV Ecosystem

The average number of patent filings in Canada has increased with a YoY rate of ~11% between 2014 – 2018. Canada is endowed with raw materials and the workforce required for EV production. This is seen from patent filings focusing on EV components finding interest with Canadian companies. More specifically, patent filings in technologies related to motor, battery, converter, and battery thermal management are gaining traction. Even though top filers operate in traditionally different areas of the EV ecosystem, almost all kinds of players (OEMs, utility providers, and suppliers) are building technologies in these fields. Canadian patent filings belonging to Nissan & Bombardier focus majorly on wireless charging technology. Kymco, a Taiwanese motorcycle manufacturer, has a number of Canadian patent filings related to battery & user authentication management.

AI and Blockchain bound to increase in the EV sector

Advanced forms of management technologies used in charging stations employ artificial intelligence, machine learning, and blockchain technology. Some patents disclose the use of Blockchain for decentralized data storage, authentication management, billing & payment systems of charging stations. AI & ML are also used in scheduling the charging of an EV, and load management, along with the billing & payment systems.

Government support

Significant investments have been made in encouraging Canadians to transition, including $587 million towards incentives under the Zero-Emission Vehicles Program (iZEV) and more than $460 million to support the construction of national charging infrastructure. Further, technologies like grid operation stability, load management for grid & charging are also being increasingly sought for patent protection. However, there are fewer players operating in this space in Canada. Government incentives & push in this segment can lead to more developments in this space.

Value Chain

Figure 1.4 shows the global value chain for EV manufacturing. Two different types of players are highlighted in the value chain. The first group of players (top) are multinational corporations that are global market leaders in the manufacturing of batteries, in the supply of EV components, and the manufacturing of electric vehicles. The second group of players (bottom) are Canadian companies active in the global EV manufacturing value chain. The full, detailed report provides illustrations of both the global and the Canadian value chains across two broad domains: EV manufacturing and EV Charging services.

Fig. 1.4 Global Value chain for EV Manufacturing

Taxonomy

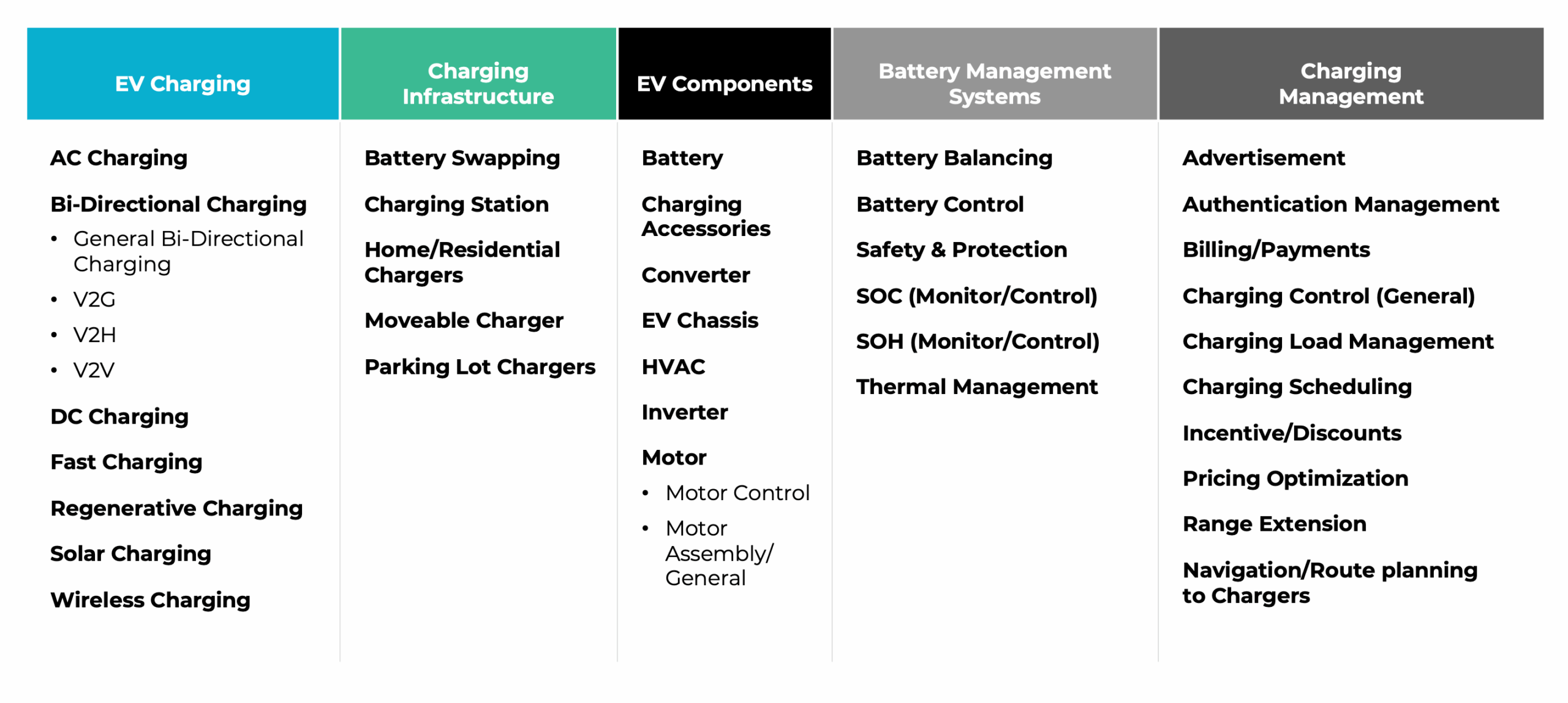

Table 1.1 gives an overview of the technology taxonomy used for bucketing the patent dataset retrieved for the detailed study.

Table 1.1 Technology taxonomy

Scope, Methodology & Assumptions

This summary report gives an overview of IAC’s detailed landscape report on the EV Ecosystem. The scope of the detailed report is limited to electric vehicles and focuses on technologies within the EV ecosystem such as EV Charging, Charging Infrastructure, EV Components, Battery Management Systems, and Charging Management. Patent filings related to technologies such as vehicle seat, vehicle body, and electric power generation & distribution are not considered for this study. Patent filings were found and categorized according to an analysis of the titles, abstracts, and claims. Only the records matching the identified EV technologies as per the above taxonomy were considered for this study. One member per patent family was analyzed based on a combination of manual and automated approaches.

IAC’s detailed IP Intelligence Reports are available exclusively to our members. To access the full Precision Agriculture report and other valuable resources, click the button below to explore the advantages of an IAC membership.

References

1 Source: Global Electric Vehicle Outlook 2022 (windows.net)

Disclaimer: The content of this document may have been derived from information from third-party databases, the accuracy of which cannot be guaranteed. IAC hereby disclaims all warranties, expressed or implied, including warranties of accuracy, completeness, correctness, adequacy, merchantability andor fitness of this document. Nothing in this document shall constitute technical, financial, professional, or legal advice or any other type of advice, or be relied upon as such. Under no circumstances shall IAC be liable for any direct, indirect, incidental, special or consequential damages that result from use of or the inability to use this document.