Precision Agriculture

Summary Landscape Report

Introduction

According to a UN report, the world’s population is expected to increase by about 2 billion people in the next 30 years1 which highlights the need to feed a larger population. This has led to an increase in the adoption of precision agriculture technologies. Precision agriculture uses a more integrated approach to respond to chronic labor shortages, increased demand, less farmland availability, and an aging population of farmers. By using data for various facets of the farming value chain, precision agriculture enables farmers to grow more using less.2

IAC’s report on Precision Agriculture illustrates the competitive landscape in this area by examining patenting trends in three broad categories (detailed hierarchical categorization defined in the taxonomy): in-field, novel farming, and post-harvest. These broad categories are inclusive of technologies which are applied across the precision agriculture value chain. Such technologies include the use of images from computer vision to train convolutional neural networks for predicting crop yields and weather patterns, etc.; using data obtained from stationary sensors (such as LiDAR, CO2 sensors, etc.); harnessing sensory data obtained from agricultural drones and satellites to monitor farming parameters like soil moisture, NPK content, and to generate precision maps that can be used to prescribe the inputs for farming operations.

The detailed report includes an analysis of a total of over 200,000 records representing unique patent families, which were retrieved and analyzed, with some records being relevant to more than one technology category of the taxonomy. It includes a detailed discussion on overall filing trends, top filers (key companies) and geographical filing trends pertaining to the three broad categories (with a granular view of sub-categories) discussed above.

Although depicted in the value chain, please note that the landscape study does not include patents related to agricultural chemicals. The scope of this report does not include an analysis of precision agriculture in livestock, poultry, and dairy farming activities.

Key Takeaways

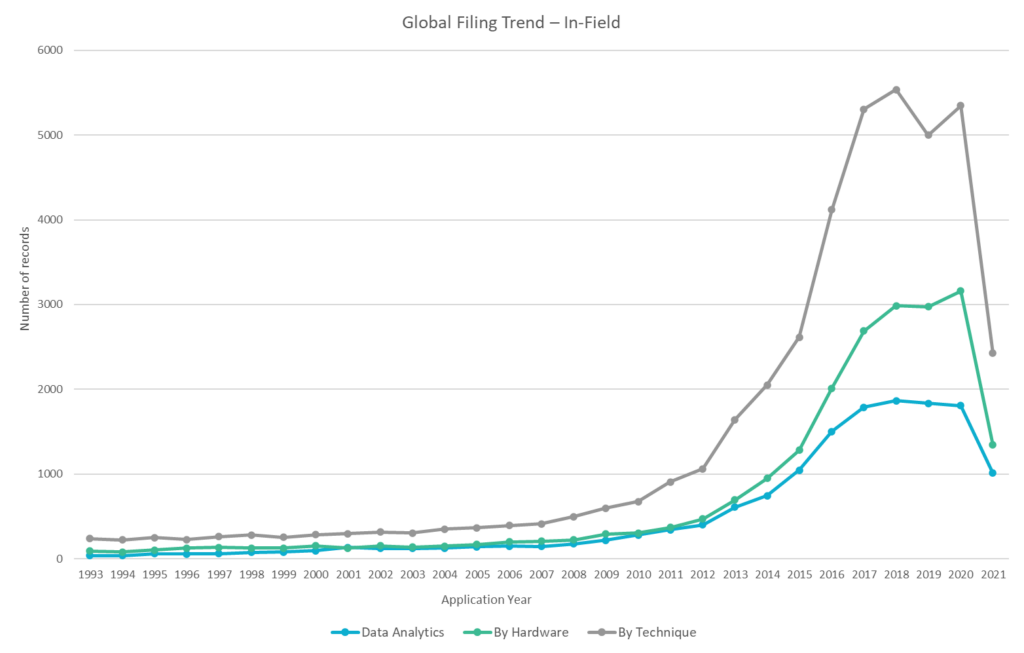

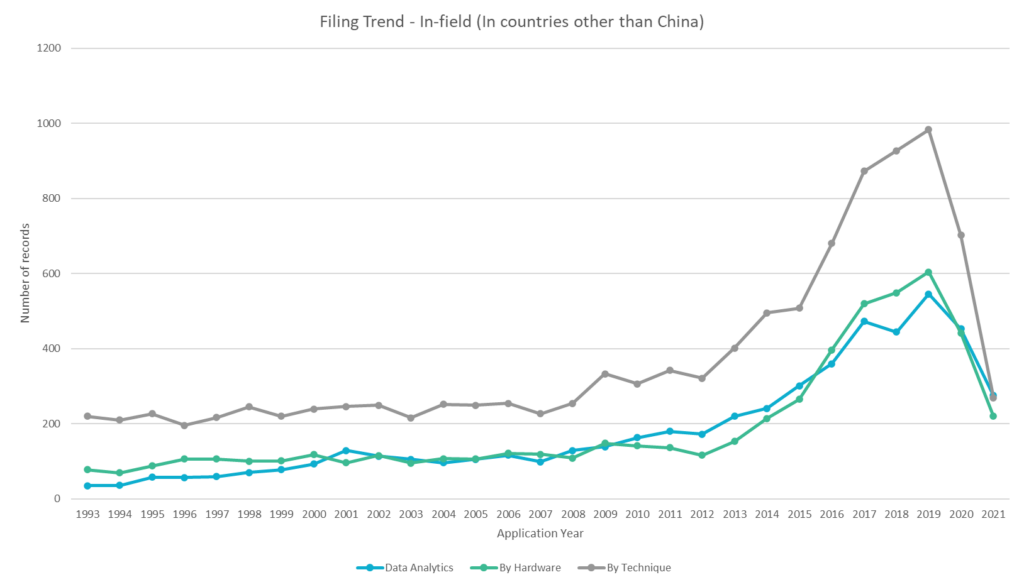

Yearly Filing trend

Patent filings have been on the rise since 2007/2008 in most categories of precision agriculture, indicating technical feasibility and sustained economic interest. There is a skew caused by the acceleration in China-only applications, which usually tend to have a higher abandonment rate. Chinese patent filings dominate the IP landscape in this field. Most of the Chinese players are active within China with little patenting activity in the rest of the world, including North America. The Chinese players also seem to be absent from the products and services market outside of China. Patent filing trends observed for China are consistent with filing trends observed in other sectors. A report from USPTO throws light on how government subsidies and mandates played a role in a drastic increase in Chinese filings.3

Key players

Deere & Co, CNH Industrial, Kubota, AGCO, and Bayer AG are some key players that are active in the precision agriculture market and are also prominent in the patent landscape. These players are known to traditionally operate in the agricultural equipment and transportation or in the chemical products space and have managed to maintain their stronghold in the precision agriculture market with investments in their R&D, other companies, or by way of acquisitions.

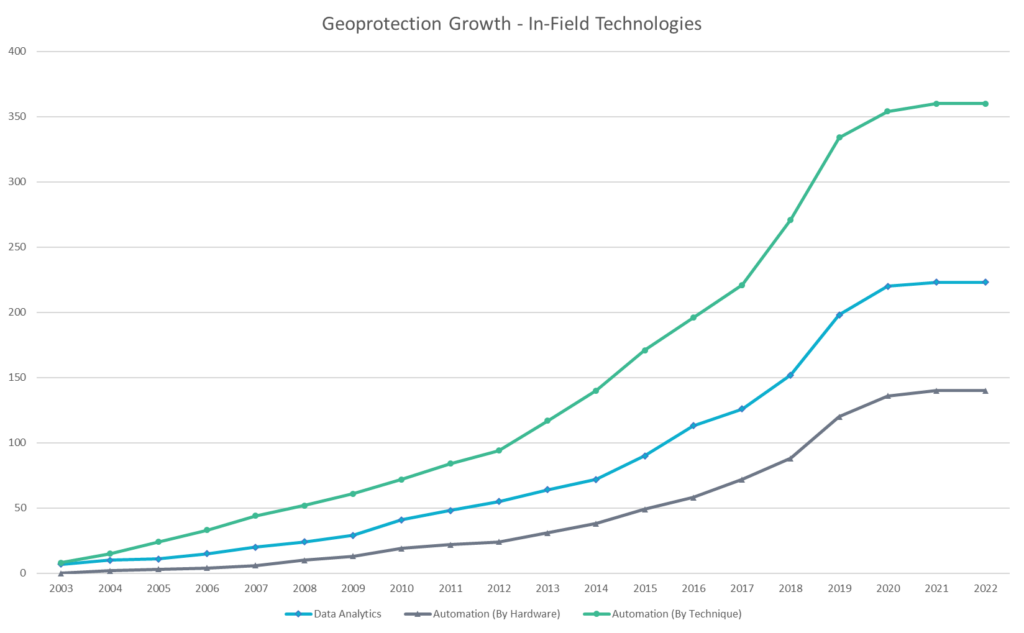

Intellectual property and Market status quo in Canada

The ratio of patent filings claiming priority to Canada against patents being filed in Canada is very low which may imply that fewer innovations originate from Canada or that other jurisdictions like the U.S. are a top choice for the initial filings. Nevertheless, Canada remains an important market for protecting innovations and overall remains between 4th and 7th on the list of top geographies. John Deere, CNH Industrial, and Bayer are some notable companies having significant patent filings in Canada encompassing different technologies of precision agriculture. The chart below shows geo-protection growth of patent filings year-on-year in Canada for the three sub-technologies in in-field precision agriculture.

Litigation overview

The detailed report on precision agriculture patent landscape identifies some patent litigations in the field. For example, the analysis shows that John Deere has been involved in several litigation cases with NPEs (non-practicing entities) and competitors. Established farm machinery manufacturers have been involved in patent litigations – through patent infringement lawsuits against competitors, complaints registered with the International Trade Commission (ITC) or filing for Inter Partes Reviews at the Patent Trial and Appeal Board. A significant number of litigations also involve NPEs such as Clear With Computers, NovelPoint Tracking LLC and more that can be found in the full report.

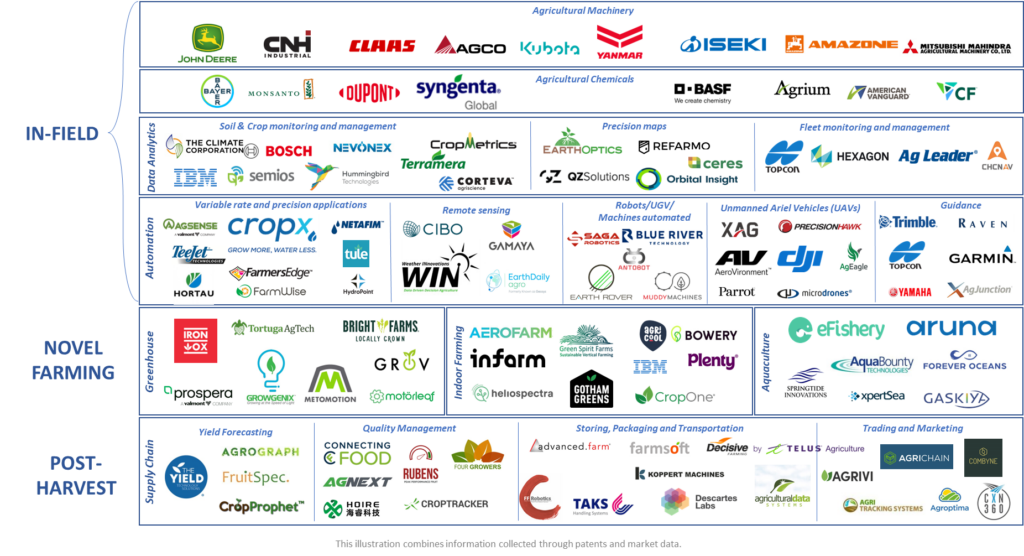

Value Chain

The value chains show an overview of various stakeholders involved in agricultural machinery, chemicals, data analytics and automation, and other players active in novel farming and post-harvest.

A full list of players in the global value chain and a Canadian value chain can be found in the detailed report.

Taxonomy

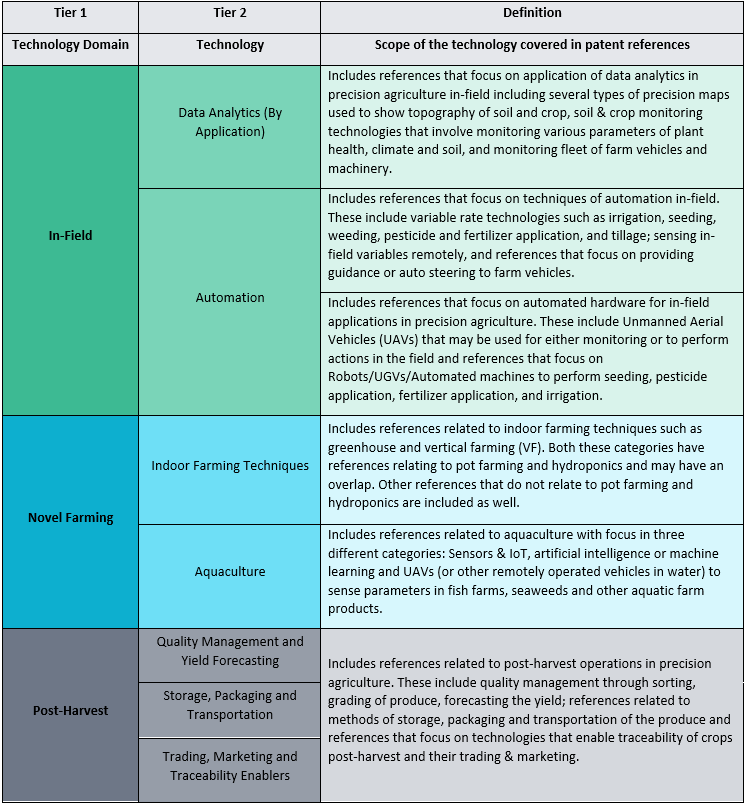

Table 1 presents an overview of the technology taxonomy, followed by a discussion of the terms used for this landscape study. The sub-categories identified here were used to organize patent data and study trends.

A more granular distribution of technology taxonomy can be seen in the detailed landscape report.

Scope & Methodology

This summary report is a condensed version of the detailed landscape report on precision agriculture which is available to IAC’s members. The detailed report provides insights and trends using time-series illustrations and quality indices to analyze patent data, supplemented by market information. From a patent study standpoint, more nuanced strategic filings made by North American and multinational companies reside under the layers of aggressive patenting activities of the Chinese players (as has become commonplace in many other technology sectors). This study attempts to uncover some of these patenting trends to inform on the activity of organizations, their strategies, their technology and market interest areas. Together with the market insights (such as M&A activities, investments, and divestments etc.), the study aims to deliver a holistic commentary on the competitive landscape. The scope of this study does not include an analysis of precision agriculture in livestock, poultry, and dairy farming activities; nor does it explore agricultural chemicals.

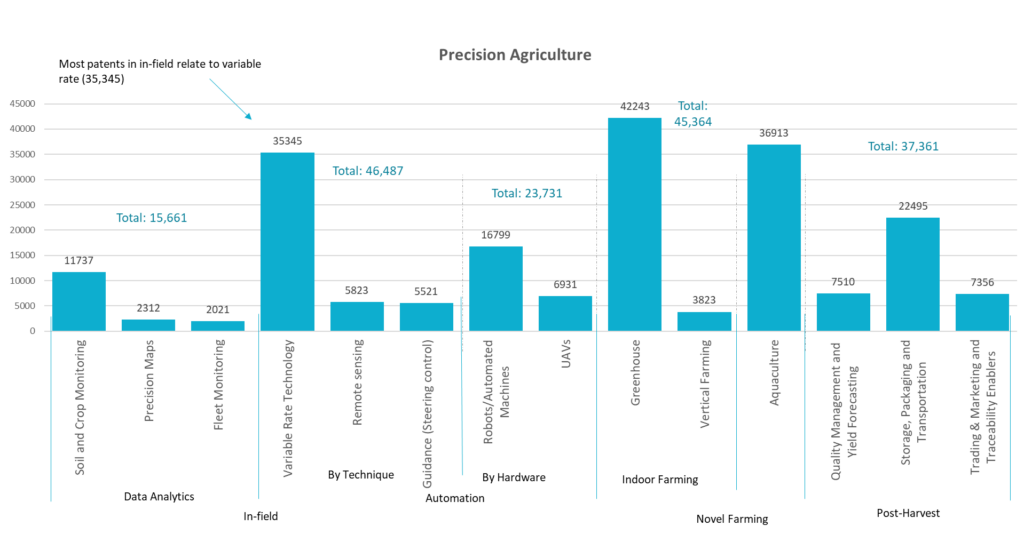

Figure 1.5 provides an overview of the number of patent filings analyzed in this study.

Innography and PatSeer were used to collect patent data in categories identified in the taxonomy. Multiple search strategies were employed to capture relevant patent datasets. These strategies used a combination of one or more strategies such as keywords, CPC classifications, and citations. Datasets were further reviewed using several techniques to reduce noise, including manual pruning based on title, abstract, and first claim.

PatSeer’s analytical tool was used to analyze the data, reduce the patent dataset to one patent per family when analytically beneficial, consider patenting activity across all jurisdictions, and create some of the visualizations provided in the report.

IAC’s detailed IP Intelligence Reports are available exclusively to our members. To access the full Precision Agriculture report and other valuable resources, click the button below to explore the advantages of an IAC membership.

Disclaimer: The content of this document may have been derived from information from third-party databases, the accuracy of which cannot be guaranteed. IAC hereby disclaims all warranties, expressed or implied, including warranties of accuracy, completeness, correctness, adequacy, merchantability and\or fitness of this document. Nothing in this document shall constitute technical, financial, professional, or legal advice or any other type of advice, or be relied upon as such. Under no circumstances shall IAC be liable for any direct, indirect, incidental, special or consequential damages that result from use of or the inability to use this document.